closed end loan vs open end

While both options use the cars residual value to calculate your monthly. Start studying Chapter 6 closed end loans vs.

Close Ended Questions Definition Types Examples

Since market demand determines the price level for closed-end funds shares typically sell either at a premium or a discount to NAV.

:max_bytes(150000):strip_icc():gifv()/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

. A borrower may repay the. A closed-end line of credit is a special type of financing facility that combines the benefits of revolving credit and also comes with a predetermined maturity date. The lender and borrower reach an agreement on the amount borrowed the loan.

Consumer credit falls into two broad categories. Closed-end funds are more likely than. Learn vocabulary terms and more with flashcards games and other study tools.

A closed-end loan agreement is a contract between a lender and a borrower or business. Open end credit is also known as a revolving line of credit and is arranged as a pre-approved amount of credit with no set end date or expiration date. Open-end leases and closed-end leases are two different ways of leasing a car.

A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender. A closed-end loan is frequently an installment loan in which the loan is issued for a specific amount and repaid in installment. A loan can be closed-end or open-end.

Two Types of Credit. Closed-end credit is a type of loan where the borrower receives a large lump sum upfront and agrees to pay back the full balance over a specific period of time like a mortgage. The borrower can reuse.

This type of mortgage. It remains open and it. An open end loan also known as a line of credit or a revolving line of credit is a type of loan where the bank offers credit to the borrower up to a certain limit and giving the.

Installment loans including a 144-month auto loan are examples of closed. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit. Closed-end installments and open-end revolving Closed-end credit.

The one you choose determines. One important feature of closed-end loans are flexible terms that allow you to adjust your loan term to fit your budget. For instance you can spread out your mortgage.

When it comes to paying off your mortgage you need to decide between two payment structures. Consumer lending products aka consumer loans can be open-end credit or closed-end credit.

Close Ended Questions Definition Types Examples

Image Result For End Of Day Cash Register Report Template Sales Report Template Worksheet Template Report Template

Bike Rentals Bike Rental Register Online Credit Card

Close Ended Questions Definition Types Examples

Looking To Buy Your First House This Ultimate Checklist For First Time Home Buyers Is The Blue First Time Home Buyers Buying Your First Home Buying First Home

Pin By Realtor Lynnette Hartley On Homebuyer S Guide Homebuyer Guide Real Estate Tips Mortgage Approval

What Are Open And Close Ended Mutual Fund Schemes I Answer 4 U

Close Ended Questions Definition Types Examples

Are You Familiar With These Acronyms These Are The Top Common Acronyms All Traders Should K Stock Trading Strategies Finance Investing Money Management Advice

The Probate Process Funeral Planning Checklist Estate Planning Checklist Funeral Planning

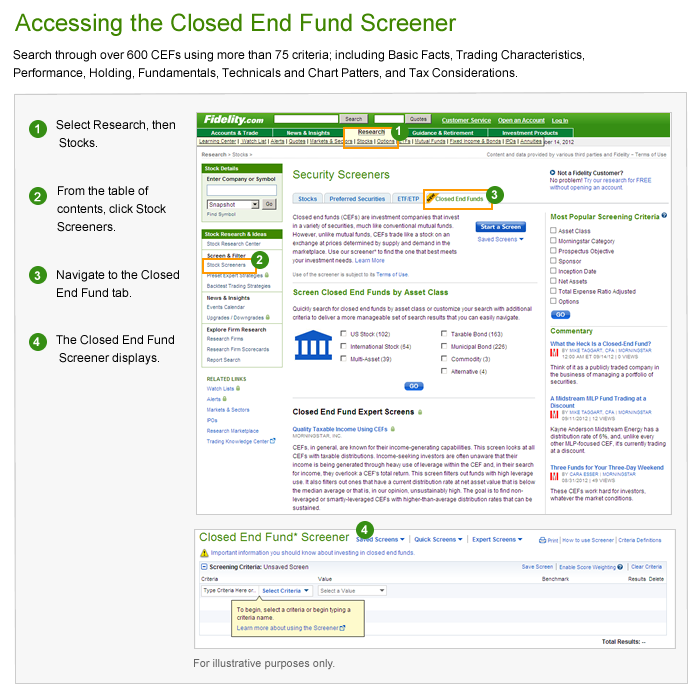

What Are Closed End Funds Fidelity

Statement Request Letter Example Letter Requesting A Statement Of Account Payoff Letter Lettering Letter Example

7 Great Referral Sources For Smart Loan Officers Mortgage Infographic Mortgage Infographic Mortgage Protection Insurance Mortgage Loan Officer

/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)